I Made $204 in One Week on Nvidia—Without Selling a Share

A step-by-step breakdown of my real Nvidia trade—how I collected $204 in cash flow in one week without selling a single share or day trading.

Hey friend,

Yesterday, I told you there was a way to earn a consistent income in the market without day trading.

Now, I’m about to show you exactly how to do it. You’ll learn from the actual trade I placed last Friday—with real numbers, real results, and real money on the line.

No theory. No hypotheticals. Just how this works in practice.

My Real Nvidia Trade (With All the Numbers)

The first step in this covered call strategy is to own at least 100 shares of a high-volume company.

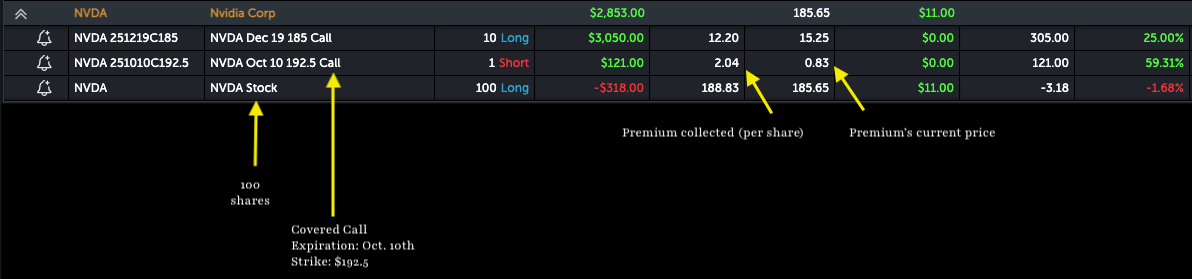

So, last Friday, I bought 100 shares of Nvidia (NVDA) at $188.83 per share.

💡 Pro tip: This strategy also works with less expensive stocks. However, if you already own 100 shares of a high-volume stock, start there.

After buying them, I went to Nvidia’s option chain and sold 1 call option with these details:

Strike price: $192.50

Expiration date: October 10th

Premium collected: $2.04 (per share)

What does that mean?

I “rented” my 100 shares to another investor for one week at $2.04 per share, immediately pocketing $204 in cash.

And no matter what the stock does next, that $204 is mine to keep.

💡 Pro tip: Selling the call option also lowered my effective cost from $188.83 to $186.79 per share ($188.83 - $2.04 = $186.79 per share). It’s like getting an instant discount on every share I just bought.

The Current Situation (Two Days Later)

Fast forward to today, Nvidia is trading around $185.65—down a few bucks from where I bought it. Yet, I’m still winning, and here’s why…

The option contract I sold has dropped in value from $2.04 to $0.83, which would be devastating as a buyer, but as a seller, it’s perfect. Now, I can buy back that same contract for just $0.83 and pocket the difference of what I sold it for.

Here’s the math:

It’s not a bad profit for just two days of “rent.” If I close this contract today, that $121 is locked in forever. But if I let it ride until it expires on October 10th, here’s what could happen...

Keep reading with a 7-day free trial

Subscribe to Earn Out Loud to keep reading this post and get 7 days of free access to the full post archives.