100% Tariffs on China... Again. How to Profit While Others Panic!

Tariffs are causing some investors to be fearful while others see opportunity. Which one are you?

Hey there,

Last Friday was a day to remember, and if you got caught on the wrong side of the political seesaw, I feel for you! But if you weren’t following the day’s events, allow me to recap:

The early morning session was fantastic. Stocks were rising, investment portfolios piled on profits, and all three major indices were at or near all-time highs. And it all happened while the US was 10 days into a government shutdown—so, it seemed like nothing could slow down the market rally.

Then, President Trump threatened China… again 🤦♂️.

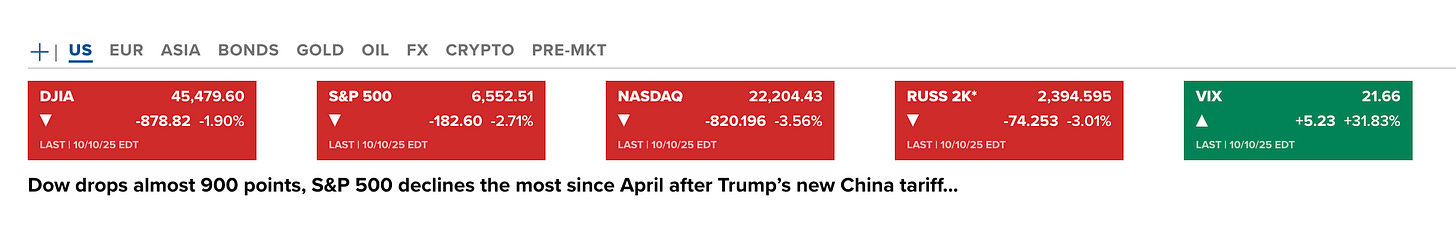

Within seconds, the Dow was down over 400 points, the Nasdaq fell to over 200 points, and the S&P dropped below 50 points of its opening bid. By the end of the trading day, more than $2 trillion had been wiped from the stock market.

CNBC showcased the damage with red banners all over their homepage, and my group chats were going nuts:

“Should I sell?”

“Will it get worse?”

“What’s going to happen and what should I do?”

But that reaction—that wave of panic that spreads from investor to investor—is exactly why most retail investors have a hard time profiting! A 2024 study by David Ardia, Clément Aymard, and Tolga Cenesizoglu supported that claim with data, concluding that beginner investors immediately sell when stocks fall but do almost nothing when stocks rise.

The Million Dollar Mistake

Selling when stocks fall and doing nothing when they rise isn’t a fault of intelligence or financial literacy. It’s actually just human nature.

Here’s the thing: Our brains evolved to respond to danger (pain) much faster than pleasure (opportunity). Losing $100 will emotionally hurt about twice as much as gaining $100 feels good. That’s why it’s hard for you to peacefully sit still when stocks are falling and you see your portfolio bleeding.

But experienced investors? Most of the time, we do the opposite. Whether we’ve learned through experience and very hard lessons (like me), examples, or some extreme amount of discipline, we’ve realized the uncomfortable truth: reacting emotionally in the stock market does not protect you—it makes you predictable prey.

When you panic and sell everything, you’re not thinking like an investor anymore. You become a participant in a very profitable game for someone else. Because every single time a retail investor runs toward the exit, an experienced investor quietly and happily buys up those exact same shares at bargain prices.

It’s one of the oldest patterns on Wall Street.

How to Flip the Script and Profit

Here’s how you can change the game in your favor.

So the next time the market drops and everyone around you panics, just pause and ask yourself a few questions:

Did the company’s business fundamentals actually change? If the business is still strong, then nothing about a short-term price drop should scare you.

Is this drop driven by emotion or by actual new information? If the headlines are fear-driven without any factual data to support the concern, that’s a clue the market is overreacting.

What are your friends doing right now? When your friends and people in your investor group chats start panic-selling, that’s often when experienced investors start quietly buying.

Smart investors don’t make their money by joining the chaos—they make it during the chaos by buying when everything is on sale.

Your Free Investor’s Edge

Every red day in the market is essentially an emotional test. Most people fail miserably by overreacting to news headlines. The successful few pass it by sticking to their plan.

If you can train yourself to stay calm—if you can hold your shares or even add to positions when fear is at its peak—you’ll find yourself wildly profiting when the market starts to rise.

The secret to long-term investing is just learning to manage your emotions.

What’s Coming Tomorrow

Tomorrow in Earn Out Loud PRO, I’ll show PRO subscribers exactly how to turn this lesson into action. We’ll pinpoint some real opportunities in a few of the market’s biggest tech names. We’ll also cover some index-based ETFs for those who are looking for a little more protection. Lastly, I’ll recap the steps you need to take to map out “opportunity zones” directly on stock charts. That way, you’ll know the exact price levels where buying makes the most sense as tariffs continue to plague the market.

I hope to see you there.

Keep thinking independently,

✍️ Isaiah from Earn Out Loud

P.S. If you aren’t a PRO subscriber yet, but want to join tomorrow’s lesson, join us by upgrading here: https://earnoutloud.substack.com/subscribe